As an employee in Minnesota, you have the right to file a workman’s comp benefits claim under Minnesota law in the event you sustain physical or mental injuries, develop an illness, or aggravate a pre-existing condition while on the job.

However, Minnesota worker’s compensation laws can be extremely difficult to navigate, only adding to the stress of worrying about the loss of income and medical treatment ahead of you.

Worst yet, the worker’s compensation insurance company will rarely voluntarily pay the total amount you’re entitled to, even if you have evidence to prove that your work was a substantial contributing factor to the injury. Attempting to take on this highly complex and nuanced process without help leaves you vulnerable to an insurance company’s attempt to deny you all the benefits entitled to injured workers.

That’s why speaking to the trusted worker’s compensation attorneys at Meuser, Yackley, & Rowland is one of the smartest moves you can make after a work injury. We know the ins and outs of Minnesota worker’s compensation law and will work diligently to protect your best interests.

We can also answer your most pressing questions, including how workers’ comp benefits are calculated based on the nature of the work injury and your current wage.

Types of Workman’s Comp Benefits

Workers’ compensation benefits are divided into four categories: wage-loss benefits, medical benefits, vocational rehabilitation benefits, and permanent partial disability benefits.

In this article, we’ll focus mainly on the wage loss benefit. That said, let’s briefly explore your right to medical treatment, vocational rehabilitation, and permanency.

Medical Benefits

The Minnesota worker’s compensation system entitles people injured on the job to have their medical bills paid by the employer.

The list of medical costs you can recover includes, in part:

- Medical appointments

- Surgical expenses

- Physical therapy

- Work hardening

- Chiropractic care

- Hospitalization

- ER/urgent care visits

- Psychological/psychiatric care, including therapy

- Prescription medications

- Specialty medical care

- Medical devices and equipment

- In-home nursing services

- Out-of-pocket medical expenses

- Mileage and travel expenses to and from medical appointments

Your employer’s workers comp insurance company will likely dispute recommended treatments and demand that you attend an Independent Medical Examination (IME).

These appointments are conducted by a physician hired by the insurance company rather than your own doctor, which often results in a bias towards the comp insurance agency fighting your claim.

Rehabilitation Benefits

You may be able to claim workers comp for professional vocational rehabilitation services. The goal is to help restore you to a job related to your former employment or find a new job with a similar economic status through vocational rehabilitation, including:

- Job placement services

- Job-seeking skills training

- Retraining to learn a new trade or profession

Employees have the right to choose their own qualified rehabilitation consultant (QRC). However, worker’s compensation insurers often try to assign injured workers to their preferred QRCs.

Significantly, an injured worker has 60 days to request a change of QRC.

If the worker’s compensation insurance company disputes liability for your injury, you are entitled to consultation through the Department of Labor and Industry’s Vocational Rehabilitation unit. They will work with you to provide rehabilitative care and vocational counseling to help you find a job that falls within the limits of your post-injury abilities.

Permanent Partial Disability Benefits

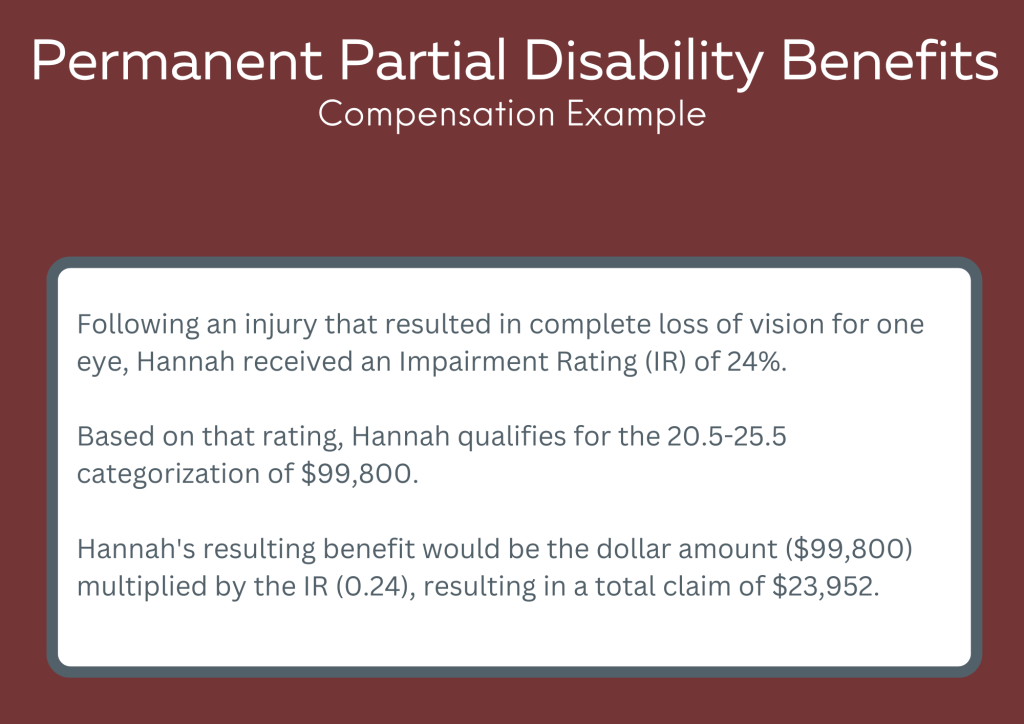

Employees who sustain a permanent disability on the job may qualify for Permanent Partial Disability (PPD) benefits to compensate for the loss of labor capacity.

Permanent disability benefits are based on the American Medical Association’s Guides to the Evaluation of Permanent Impairment to ensure that the Permanent Partial Disability Rating is fair and consistent with other cases across the United States.

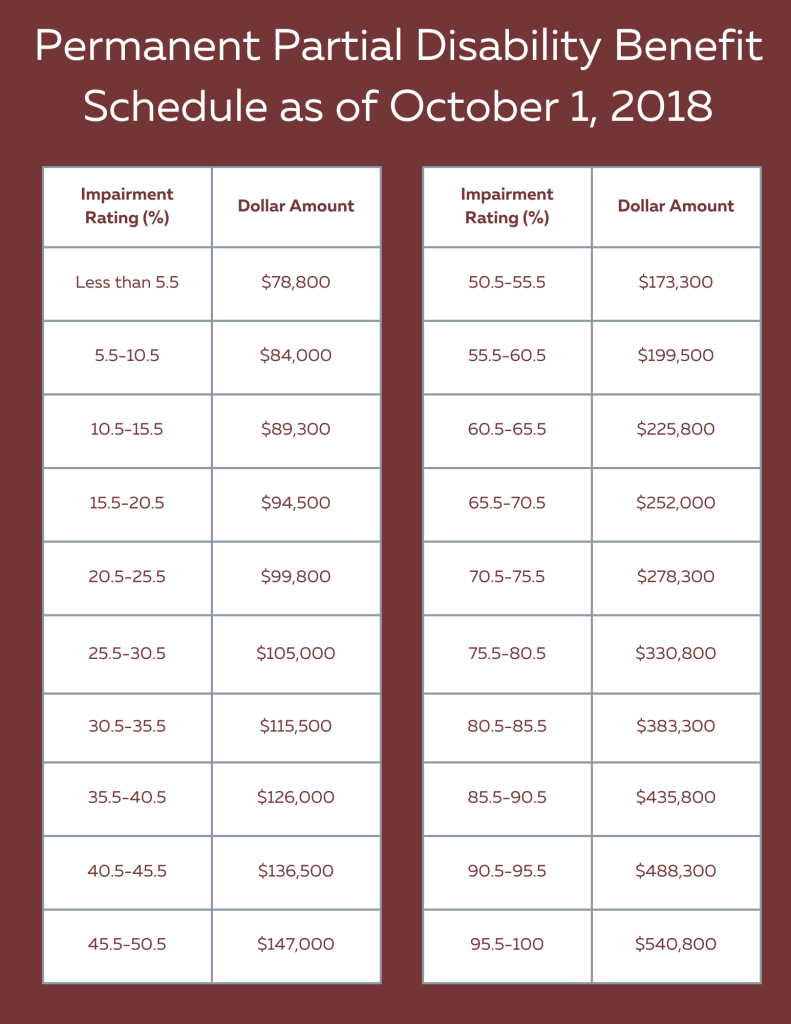

This system determines your workman’s comp benefits based on how much of your body is disabled multiplied by a specific dollar amount determined by the work comp statute and rules:

PPD Workers Comp Limitations

PPD is a set amount determined by the benefit schedule. PPD is payable after you reach Maximum Medical Improvement. PPD can be paid over time or as a single payment.

How Wage Loss Workman’s Comp Benefits Are Calculated

When seeking workers’ compensation benefits for lost wages, the exact calculations and length of time you’re eligible for payment depends on which of these three wage loss benefits categories your injury qualifies for:

- Temporary Total Disability benefits

- Temporary Partial Disability benefits

- Permanent Total Disability benefits

Temporary disability benefits apply if you can eventually recover from the work-related injury with time and proper medical intervention. Examples would include a broken bone, concussion, or any other condition that prevents you from working in your particular role effectively and safely in the short term.

Permanent disability workers’ compensation pay applies to any on-job injury that will prevent you from working for the rest of your life such as significant physical and mental health injuries, amputation, or blindness..

If you’re unsure whether your injury qualifies for temporary disability benefits or permanent disability benefits under the Minnesota Workers Compensation Act, we encourage you to schedule a free consultation to discuss whether this might apply to your situation.

Temporary Total Disability Benefits

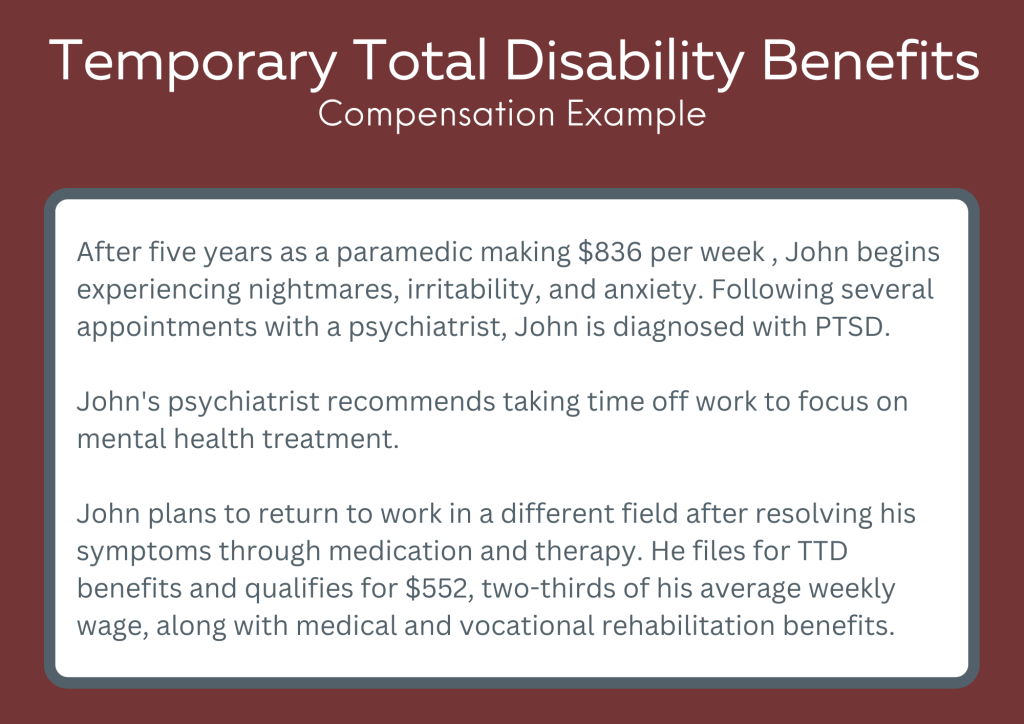

When injured workers need time to recover from workplace accidents but plan to return to work once they are medically cleared, they may be eligible for Temporary Total Disability (TTD) benefits amounting to two-thirds of their average weekly wage.

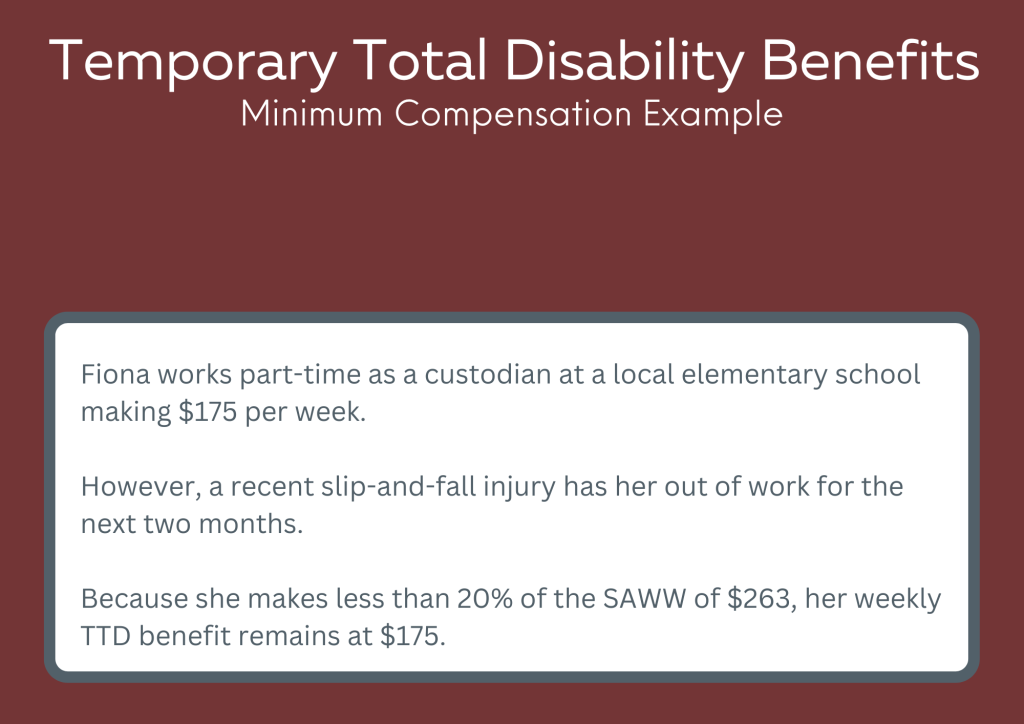

However, TTD workers comp benefits are capped by a minimum and maximum compensation amount that is recalculated annually.

Minnesota changes the maximum compensation amount each October based on an evaluation of the Statewide Average Weekly Wage (SAWW). As of October 2022, the SAWW (and maximum workers’ compensation amount) is $1,287 per week, and the maximum is 102% of that or $1,312.74 per week.

Workers receiving TTD benefits are also protected by a minimum cap of 20% of the maximum ($262.55 per week in 2022) or the employee’s weekly wage, whichever is less.

TTD Workers Comp Benefits Limitations

You may qualify for Temporary Total Disability benefits until:

- You are medically cleared to return to work.

- You leave the workforce for some reason other than your injury.

- You are cleared to return to work but refuse to make a diligent job search.

- You reject an offer of suitable gainful employment within your work restrictions.

- Up to 130 weeks, the maximum allowed time for TTD.

- 90 days after you’ve reached Maximum Medical Improvement (MMI)

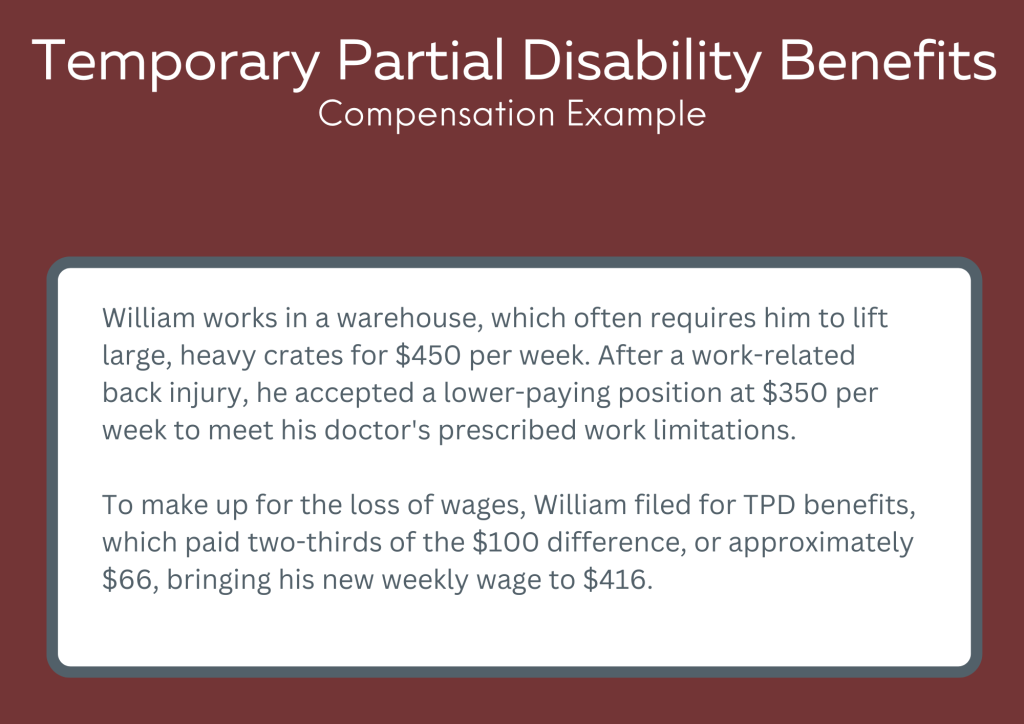

Temporary Partial Disability Benefits

In some cases, an injured employee returns to work but cannot resume the same number of hours or position they were in prior, resulting in partially lost wages.

They can then qualify for Temporary Partial Disability (TPD) benefits, which is two-thirds of the difference between what the employee earned prior to the injury and their current rate of pay.

TPD Workers Comp Limitations

For injuries after 10/1/18, these wage loss benefits have a time limit of 275 weeks. Additionally, you can receive payments up to 450 weeks following the injury.

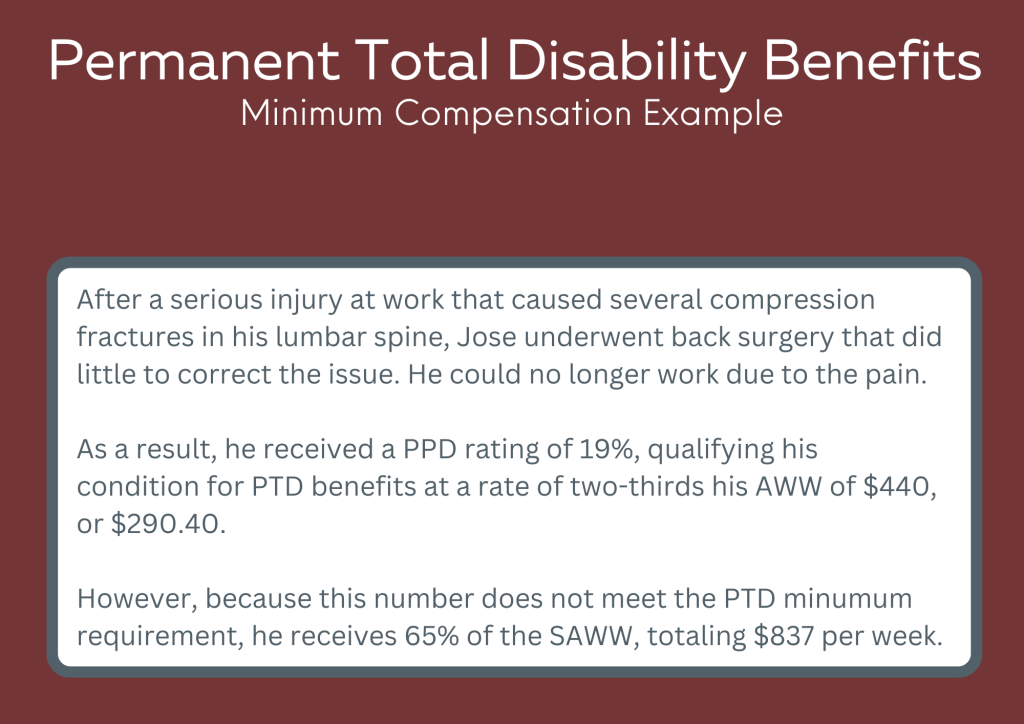

Permanent Total Disability Benefits

To qualify for Permanent Total Disability benefits (PTD) wage loss benefits, the sustained injury must prevent you from ever being able to return to work.

In Minnesota, you may qualify for PTD under the following circumstances:

- Injuries that prevent you from returning to work in any capacity

- Total loss of sight in both eyes

- Loss of both arms at the shoulder

- Loss of both legs at a point too high to use prosthetics

- Complete and permanent paralysis

- Total and permanent loss of mental faculties

To qualify for PTD benefits, you must also have a minimum PPD rating. After October 1, 1995, the minimum PPD rating you must have to qualify for PTD benefits is:

- 17% PPD rating of the whole body

- 15% PPD rating of the whole body and at least 50 years old at the time of injury

- 13% PPD rating, at least 55 years old at the time of injury, and not have a high school diploma or GED

The calculation rate for PTD workman’s comp benefits is the same as TTD– two-thirds of your AWW at the time of injury. Part-time employees qualify for payment based on the average work week of the occupation, typically 40 hours.

PTD benefits are limited to the same maximum weekly amount as TTD but have a much higher minimum of 65% of the SAWW.

PTD Workers Comp Limitations

For injuries before 10/1/18, PTD benefits continue through the presumed retirement age determined by social security.

For injuries after 10/1/19, PTD wage loss benefits continue through age 72.

If an injured worker is also receiving SSDI benefits, then work comp payments continue until workers’ compensation insurance has paid out $25,000 in benefits, at which point weekly work comp payments are reduced by the amount paid in Social Security Disability Insurance benefits.